Arizona Christian School Tuition Organization v. Winn

What's at Stake

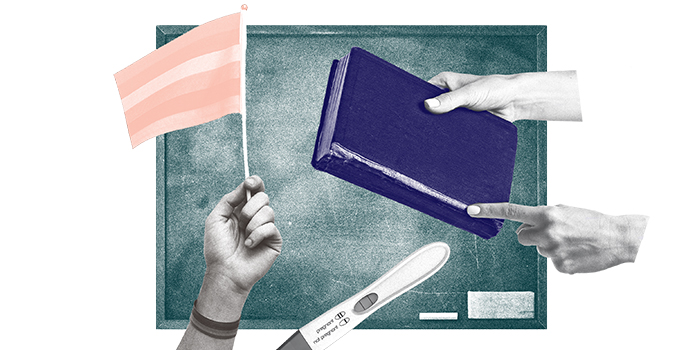

Whether Arizona’s use of tax credits funneled through state-certified and state-supervised non-profits to award student scholarships based on religious criteria and for use in religious schools violates the Establishment Clause.

Stay informed about our latest work in the courts.

By completing this form, I agree to receive occasional emails per the terms of the ACLU's privacy statement.

Summary

Arizona has created a unique system of funding religious instruction by allowing state-certified and state-supervised non-profits that exist for no other purpose to distribute taxpayer funds obtained through tax credits for student scholarships. A substantial portion of these taxpayer funds are distributed on the basis of religious criteria for use in religious schools. The ACLU represents a group of taxpayers who have challenged this system as a violation of the Establishment Clause.

Legal Documents

Press Releases

Supreme Court Rules Arizona Taxpayers Lack Standing To Challenge Tax Credit System Used To Award Religious-Based Scholarships

Supreme Court Hears ACLU Case Challenging Discriminatory Arizona School Tuition Program